5/02/22 Wealth Management Insights

Top News Of Last Week

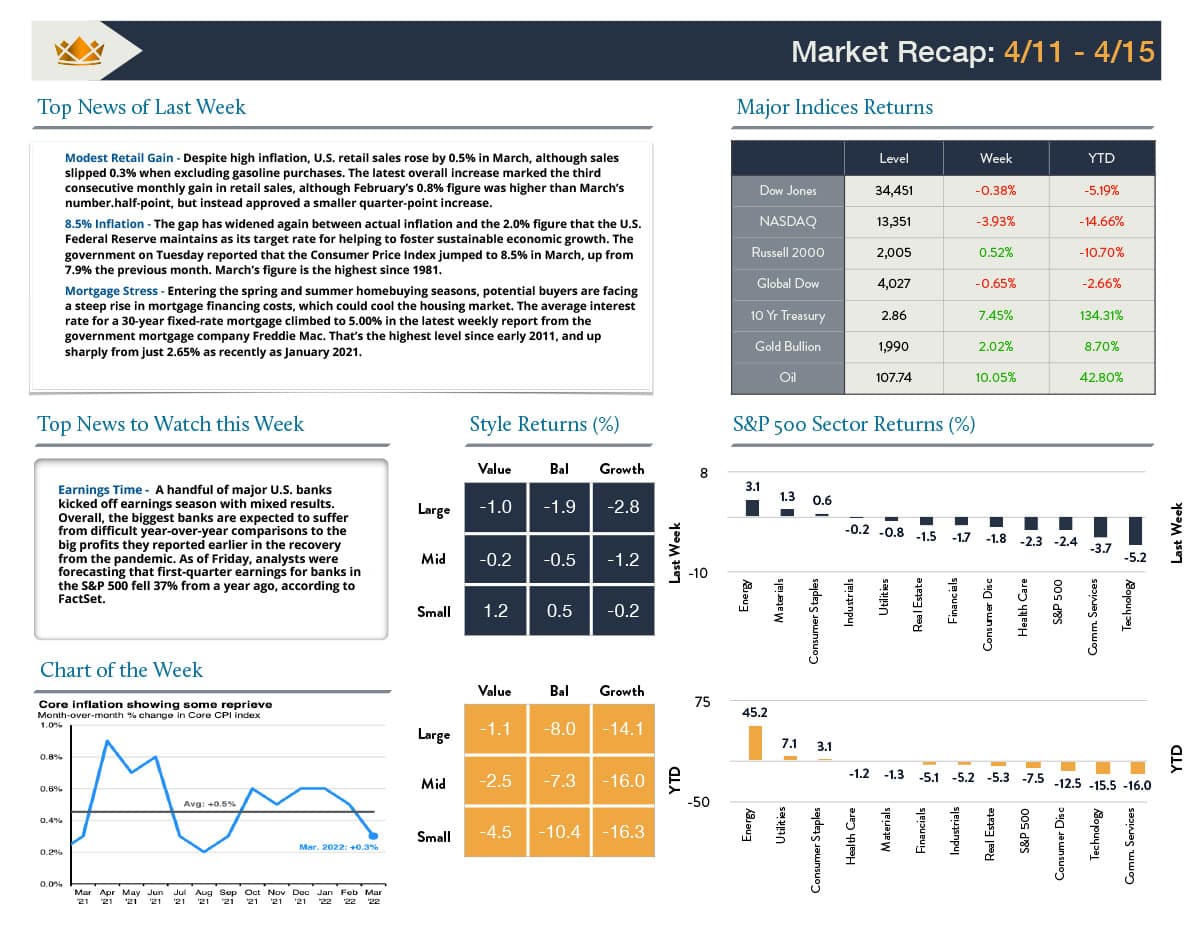

April Showers – There was no relief for the stock market in April on the heels of a tough first quarter. The major indexes were all down for the month, with the NASDAQ sustaining the biggest decline at more than 13%-its worst month since October 2008-amid broad weakness for technology stocks. The S&P 500 was down nearly 9% and the Dow almost 5%

Dollar in Demand – The U.S. dollar’s value versus a basket of other major currencies climbed on Thursday to the highest level since March 2020, when the coronavirus pandemic sent stocks plummeting and investors piling into the dollar. The greenback has surged this year amid a diminished outlook for the global economy and policy tightening by the U.S. Federal Reserve.

GDP Speed Bump? – The U.S. economy reversed course in this year’s first quarter, when it shrank at an annual rate of 1.4% after posting full-year growth of 5.7% in 2021. While many economists believe the first-quarter setback was temporary, it marked the worst quarterly GDP result since the second quarter of 2020, when the pandemic triggered a brief recession.

Top News Of The Week

Fed Ahead- In addition to a monthly jobs report scheduled to be released on Friday, the new week’s agenda includes a policy meeting of the U.S. Federal Reserve that concludes on Wednesday. Policymakers are widely expected to approve an interest-rate increase of half a percentage point-twice as big as the quarter point increase approved in mid-March.

If you are in the Indianapolis area and looking for financial advice we are happy to have the meeting with you in person at our offices in Carmel, Indiana, by Zoom or over the phone. Visit our “Schedule An Appointment” page and book a 15-minute “Relationship Building Call” to start the process. The goal during this brief conversation is to understand what your unique goals and objectives are and whether or not Crown Haven can serve as an ideal fit to help.