September 19, 2022 Wealth Management Insights

A hotter-than-expected inflation report sent stocks sharply lower last week as investors faced the prospect of more aggressive interest rate hikes by the Federal Reserve for perhaps a longer period.

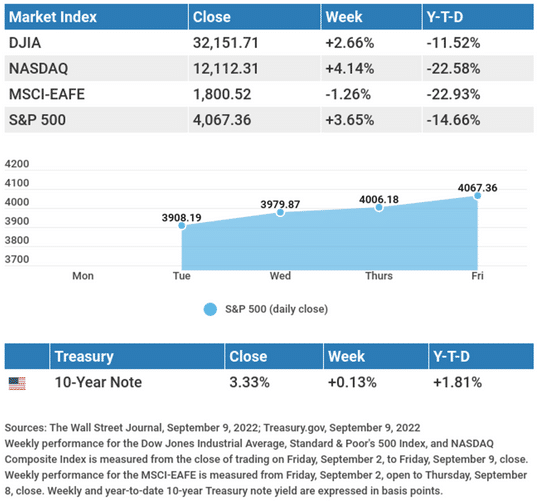

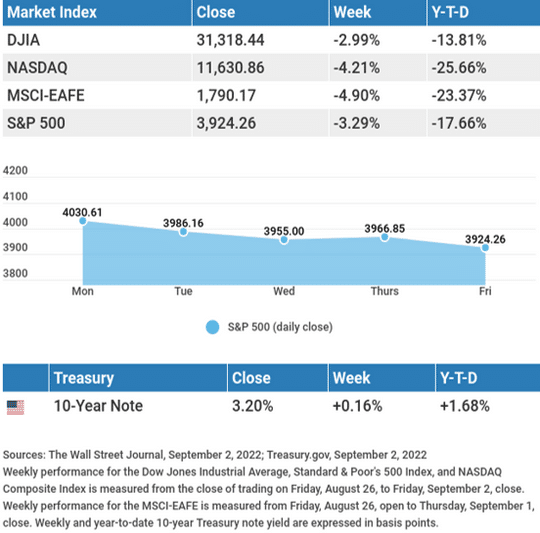

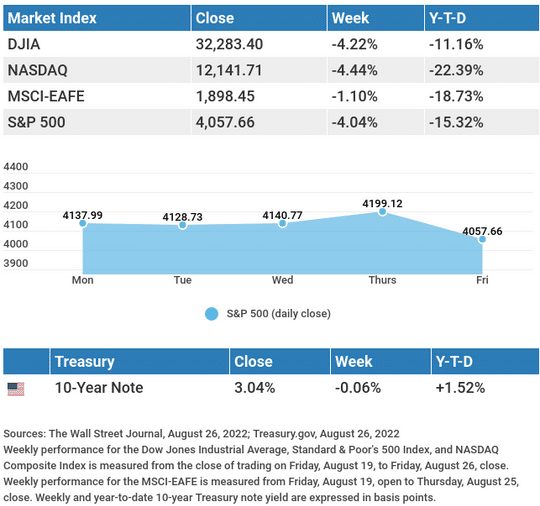

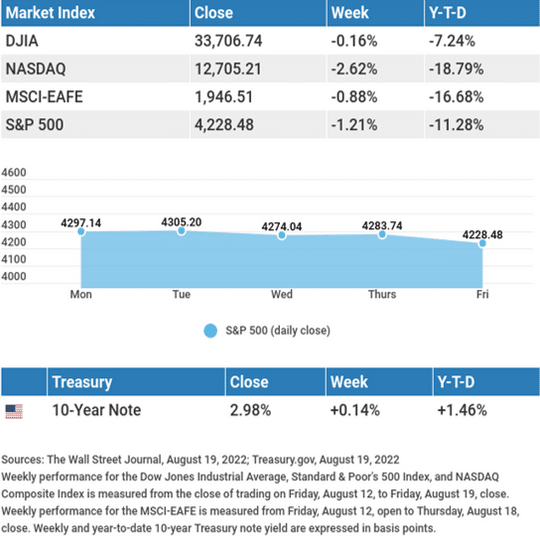

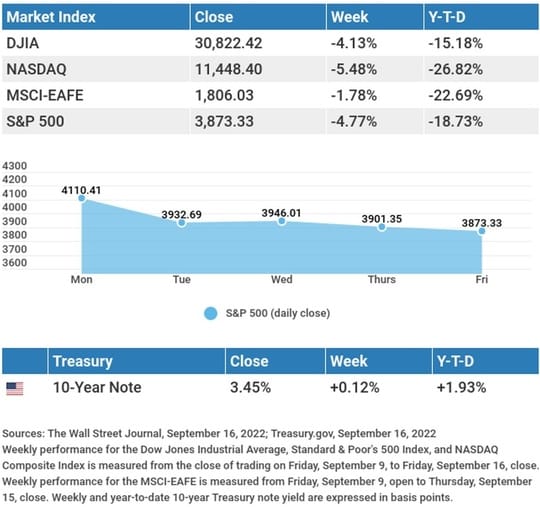

The Dow Jones Industrial Average fell 4.13%, while the Standard & Poor’s 500 lost 4.77%. The Nasdaq Composite index dropped 5.48% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, dipped 1.78%.1,2,3

Inflation Deflates Markets

Stocks suffered their worst day in more than two years last Tuesday as markets were caught off-guard by a higher-than-anticipated August inflation report.

Markets expected the August report to show a substantial cooling of inflation, potentially allowing the Fed to ease up on interest rate hikes. Instead, the elevated inflation number not only undercut those easing hopes but raised the possibility of a more significant rate hike. On Tuesday, traders assigned a 28% probability of a 100 basis point hike, from a 0% chance just the day before. Price action remained choppy for the remainder of the week, closing the week with additional losses as a global package-delivery company warned of a worldwide recession.4

August CPI Disappoints

August’s Consumer Price Index (CPI) rose 8.3% from a year ago, showing a continued deceleration in price increases (July’s CPI was 8.5%, and June’s was 9.1%). Despite moderating price increases, traders were disappointed, given the general expectation of a more substantial slowdown in inflation.5

Core inflation (excluding food and energy) was particularly alarming to investors, which jumped 6.3% year-over-year. That number was well above the 5.9% rate from June and July. From the market’s perspective, sufficient inflationary pressures exist for the Fed to maintain its hawkish interest rate policy for possibly longer than investors had hoped.6

This Week: Key Economic Data

Tuesday: Housing Starts.

Wednesday: Federal Open Market Committee (FOMC) Meeting Announcement. Existing Home Sales.

Thursday: Index of Leading Economic Indicators. Jobless Claims.

Friday: Purchasing Managers’ Index (PMI) Composite.

Source: Econoday, September 16, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: AutoZone, Inc. (AZO).

Wednesday: General Mills, Inc. (GIS).

Thursday: Costco Wholesale Corporation (COST), FedEx Corporation (FDX), Lennar Corporation (LEN).

Source: Zacks, September 16, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Meet With Crown Haven Wealth Advisors

For a limited time, Casey Marx- Founder & CEO of Crown Haven Wealth Advisors, is accepting new clients. Many have said they’re concerned about inflation and rising interest rates. Now, tapping into 40 years of combined experience, Casey and his team of experts are here to help.

Secure your retirement. Click here to schedule a complimentary relationship visit or call (317) 564-4691 to speak with one of our specialists.

Footnotes and Sources

1. The Wall Street Journal, September 16, 2022

2. The Wall Street Journal, September 16, 2022

3. The Wall Street Journal, September 16, 2022

4. The Wall Street Journal, September 13, 2022

5. The Wall Street Journal, September 13, 2022

6. The Wall Street Journal, September 13, 2022

7. IRS.gov, March 16, 2022

8. USAPickleball.org, May 26, 2022