4/04/22 Wealth Management Insight

Top News to Watch This Week

Longer-Term View – Although Wall Street analysts have recently scaled back their expectations for quarterly earnings reports that begin coming out this month, they’ve been raising their forecasts for the rest of the year, according to FactSet. In January through March, analysts cut their first-quarter earnings estimates for companies in the S&P 500 by 0.7% while lifting them for the subsequent three quarters by 1.6%, 2.4%, and 3.9%, respectively.

Weekly Wealth Management Insight

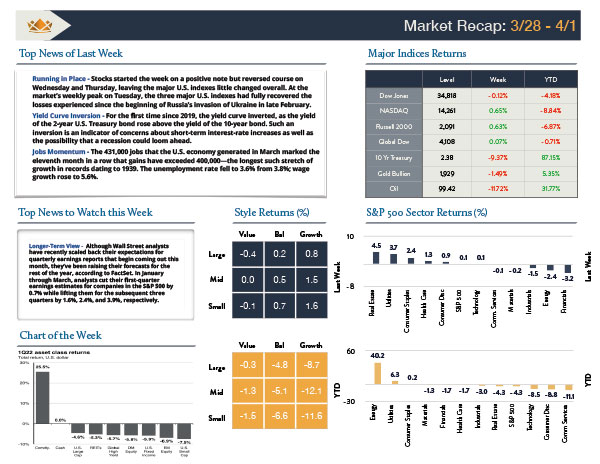

Running in Place – Stocks started the week on a positive note but reversed course on Wednesday and Thursday, leaving the major U.S. indexes little changed overall. At the market’s weekly peak on Tuesday, the three major U.S. indexes had fully recovered the losses experienced since the beginning of Russia’s invasion of Ukraine in late February.

Yield Curve Inversion – For the first time since 2019, the yield curve inverted, as the yield of the 2-year U.S. Treasury bond rose above the yield of the 10-year bond. Such an inversion is an indicator of concerns about short-term interest-rate increases as well as the possibility that a recession could loom ahead.

Jobs Momentum – The 431,000 jobs that the U.S. economy generated in March marked the eleventh month in a row that gains have exceeded 400,000-the longest such stretch of growth in records dating to 1939. The unemployment rate fell to 3.6% from 3.8% ; wage growth rose to 5.6%.