4/18/22 Wealth Management Insights

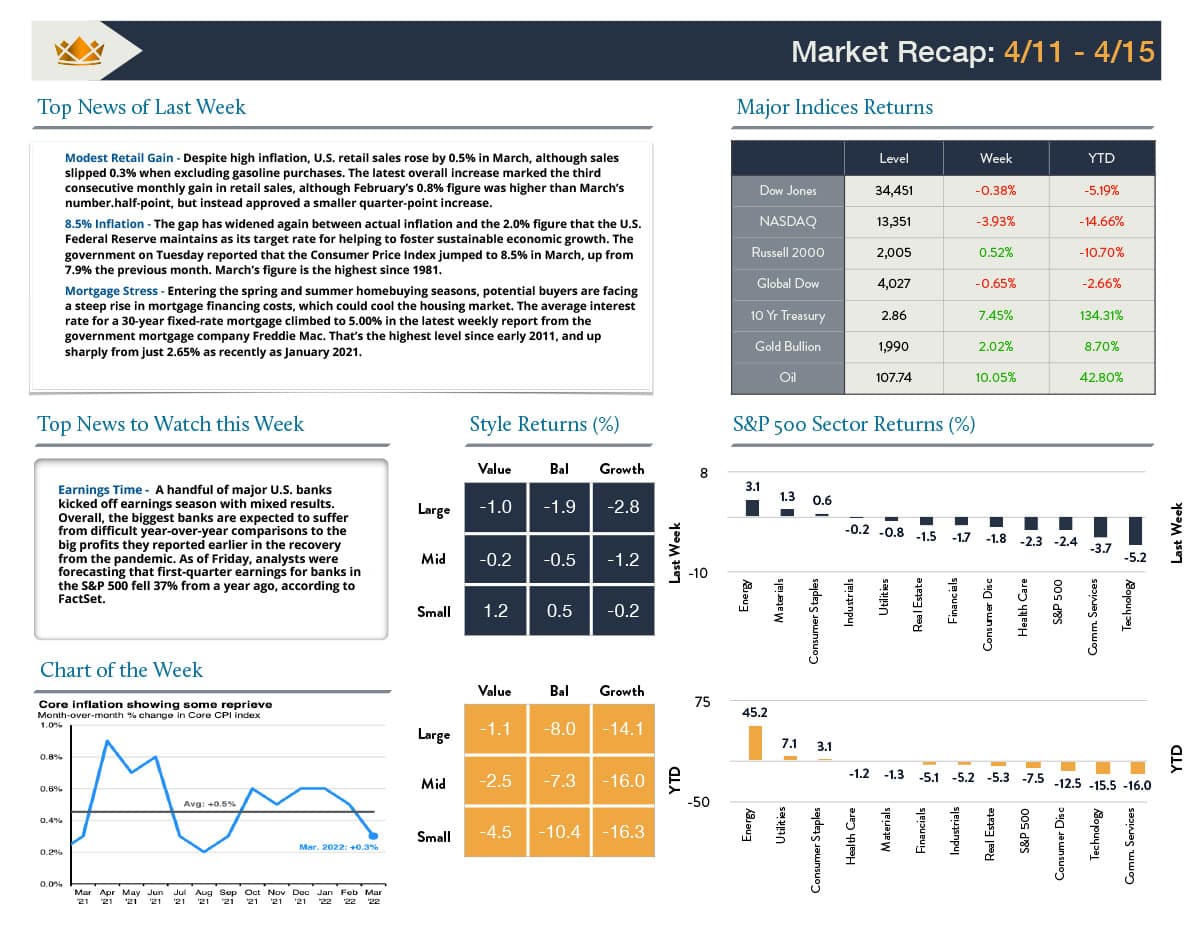

Earnings Time – A handful of major U.S. banks kicked off earnings season with mixed results. Overall, the biggest banks are expected to suffer from difficult year-over-year comparisons to the big profits they reported earlier in the recovery from the pandemic. As of Friday, analysts were forecasting that first-quarter earnings for banks in the S&P 500 fell 37% from a year ago, according to FactSet.

Modest Retail Gain – Despite high inflation, U.S. retail sales rose by 0.5% in March, although sales slipped 0.3% when excluding gasoline purchases. The latest overall increase marked the third consecutive monthly gain in retail sales, although February’s 0.8% figure was higher than March’s number.half-point, but instead approved a smaller quarter-point increase.

8.5% Inflation – The gap has widened again between actual inflation and the 2.0% figure that the U.S. Federal Reserve maintains as its target rate for helping to foster sustainable economic growth. The government on Tuesday reported that the Consumer Price Index jumped to 8.5% in March, up from 7.9% the previous month. March’s figure is the highest since 1981.

Mortgage Stress – Entering the spring and summer homebuying seasons, potential buyers are facing a steep rise in mortgage financing costs, which could cool the housing market. The average interest rate for a 30-year fixed-rate mortgage climbed to 5.00% in the latest weekly report from the government mortgage company Freddie Mac. That’s the highest level since early 2011, and up sharply from just 2.65% as recently as January 2021.