5/23/22 Wealth Management Insights

Brush with a Bear

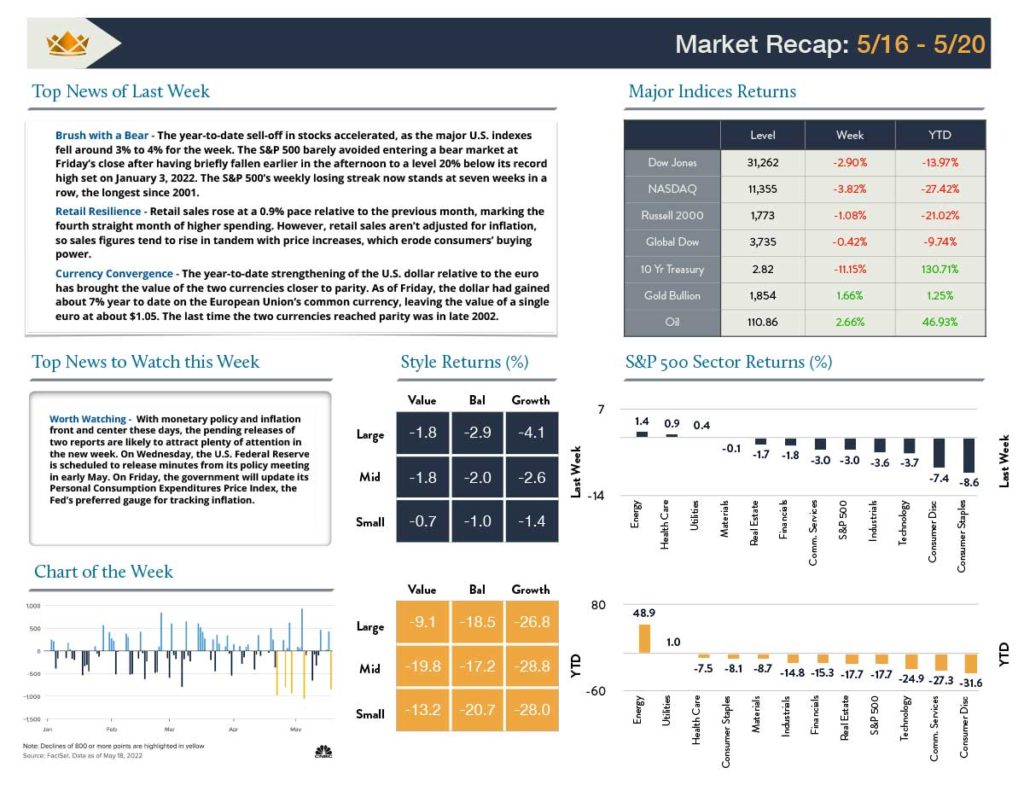

The year-to-date sell-off in stocks accelerated, as the major U.S. Indexes fell around 3% to 4% for the week. The S&P 500 barely avoided entering a bear market at Friday’s close after having briefly fallen earlier in the afternoon to a level 20% below its record high set on January 3, 2022. The S&P 500’s weekly losing streak now stands at seven weeks in a row, the longest since 2001.

Retail Resilience

Retail sales rose at a 0.9% pace relative to the previous month, marking the fourth straight month of higher spending. However, retail sales aren’t adjusted for inflation, so sales figures tend to rise in tandem with price increases, which erode consumers’ buying power.

Currency Convergence

The year-to-date strengthening of the U.S. dollar relative to the euro has brought the value of the two currencies closer to parity. As of Friday, the dollar had gained about 7% year to date on the European Union’s common currency, leaving the value of a single euro at about $1.05. The last time the two currencies reached parity was in late 2002.

Top News to Watch this Week

Worth Watching

With monetary policy and inflation front and center these days, the pending releases of two reports are likely to attract plenty of attention in the new week. On Wednesday, the U.S. Federal Reserve is scheduled to release minutes from its policy meeting in early May. On Friday, the government will update its Personal Consumption Expenditures Price Index, the Fed’s preferred gauge for tracking inflation.