6/13/22 Wealth Management Insights

Please enjoy the 6/13/22 Wealth Management Insights edition from Crown Haven Wealth Advisors, Indiana’s #1 independent and fiduciary full-service firm.

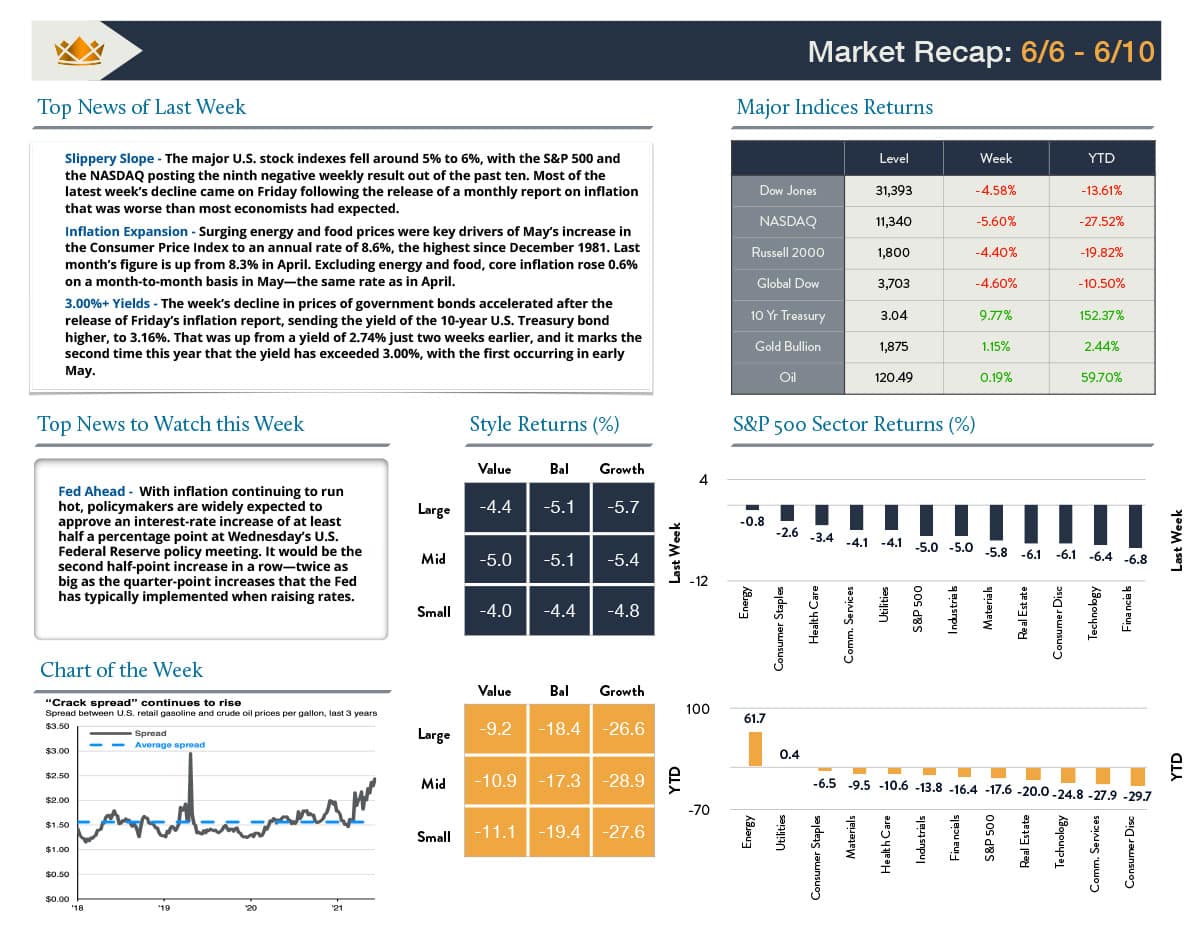

Slippery Slope – The major U.S. stock indexes fell around 5% to 6%, with the S&P 500 and the NASDAQ posting the ninth negative weekly result out of the past ten. Most of the latest week’s decline came on Friday following the release of a monthly report on inflation that was worse than most economists had expected.

Inflation Expansion – Surging energy and food prices were key drivers of May’s increase in the Consumer Price Index to an annual rate of 8.6%, the highest since December 1981. Last month’s figure is up from 8.3% in April. Excluding energy and food, core inflation rose 0.6% on a month-to-month basis in May-the same rate as in April.

3.00%+ Yields – The week’s decline in prices of government bonds accelerated after the release of Friday’s inflation report, sending the yield of the 10-year U.S. Treasury bond higher, to 3.16%. That was up from a yield of 2.74% just two weeks earlier, and it marks the second time this year that the yield has exceeded 3.00%, with the first occurring in early May.

Top News to Watch this Week

Fed Ahead – With inflation continuing to run hot, policymakers are widely expected to approve an interest-rate increase of at least half a percentage point at Wednesday’s U.S. Federal Reserve policy meeting. It would be the second half-point increase in a row-twice as big as the quarter-point increases that the Fed has typically implemented when raising rates.